Overview

Hi IRISnet community, StaFiHub (https://www.stafihub.io/) is a Cosmos SDK built project developed by StaFi protocol to provide Liquid Staking Derivative SDK solution for Cosmos Eco projects. And we want to propose a liquid staking solution called rIRIS (rIRIS Solution) for IRISnet’s native token $IRIS, based on StaFiHub’s Liquid Staking SDK.

What’s rIRIS Solution?

rIRIS solution developed on StaFiHub’s Liquid Staking SDK will help IRISnet community to stake their $IRIS tokens to earn the staking rewards from the IRISnet Tendermint network, while still enjoying the liquidity of their staked $IRIS tokens through the voucher token called $rIRIS.

The steps for users are very simple:

-

Stake $IRIS tokens through StaFiHub;

-

Get the $rIRIS tokens which represent your staked assets and attached staking rewards.

What’s $rIRIS Token?

$rIRIS token is the staking derivative issued by StaFiHub when users stake their $IRIS tokens through StaFiHub.

$rIRIS token has the following features:

- Staking Reward Bearing: The rToken value will keep increasing due to the staking rewards generated.

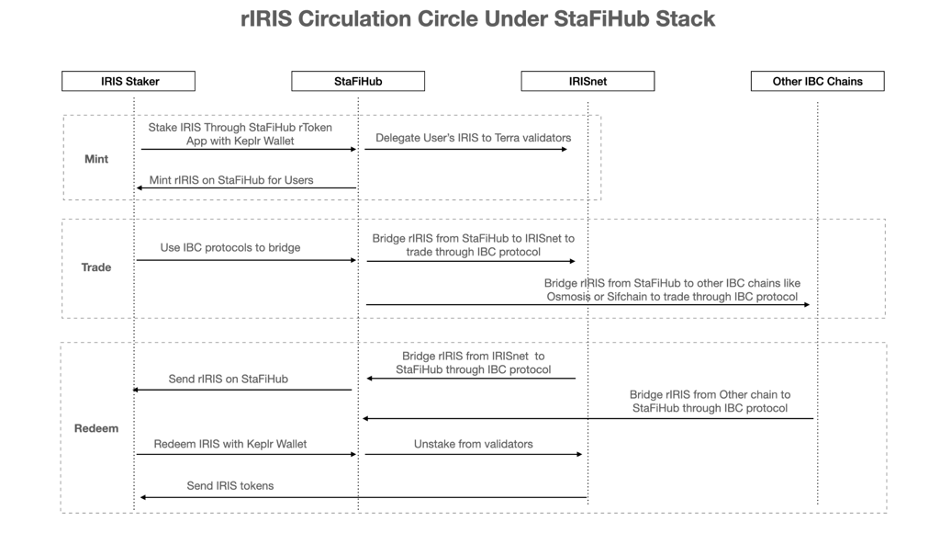

- Transferable Through IBC: The rToken could be transferred at any time to any IBC chains in Cosmos.

- Tradable: The rToken could be traded on any Cosmos Eco supportive DEXes including rDEX( developed by StaFiHub) or Osmosis.

- Redeemable: The rToken could be used to redeem the corresponding native tokens and staking rewards at any time without permission.

Why IRISnet Community Needs rIRIS?

- For $IRIS token holders:

- Great Liquidity: There will be no need to worry about the liquidity problem caused by the 3 week unbonding period. rIRIS App users could always trade rIRIS tokens to gain the liquidity at any time they want.

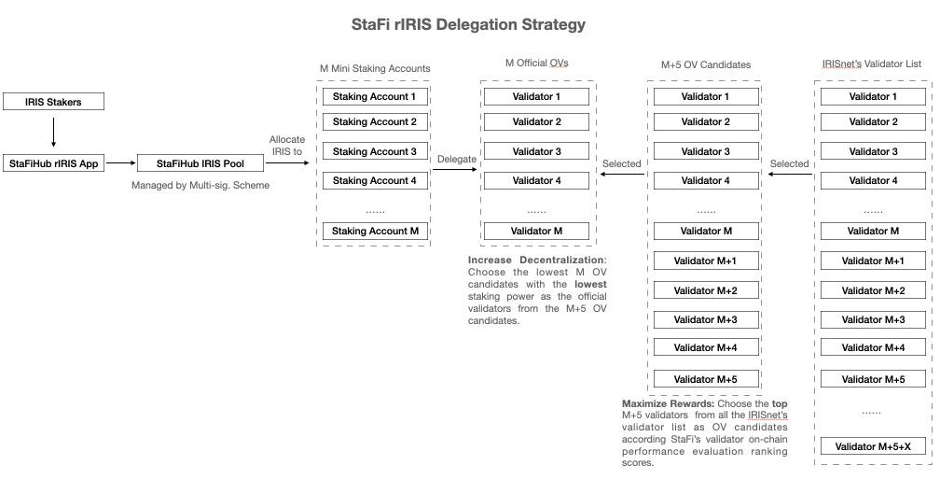

- Easy to get the maximized staking rewards: No need to learn the Tendermint mechanism any more. Users only need to follow 2 or 3 simple steps to stake IRIS through StaFiHub, which will automatically select the best validator to delegate by the profit maximization strategy.

- For The Network Security:

- Higher Staking Ratio: rIRIS solution will help solve the liquidity of staked assets, thus improving the willingness of the community to stake.

- Higher staking ratio means higher security of the IRISnet network.

rIRIS Solution Design

rIRIS solution design is mainly based on the StaFiHub Liquid Staking SDK built by StaFi protocol to provide liquid staking solutions for Cosmos Eco projects very quickly and easily. Please check the introduction of SDK Integrations.

The core of the rIRIS solution design includes the following elements:

-

Staking Pool: A pool is a multisig account of IRISnet chain to gather rIRIS user’s staked IRIS tokens and invoke staking related calls such as Bond, Unbond and Claim on the IRISnet to earn more tokens. This multisig account will be controlled by StaFiHub, IRISnet Foundation and other parties in the IRISnet community.

-

LiquidityBond: LiquidityBond is the entry point for users to obtain rIRIS on StaFiHub. Users can submit their transfer voucher to mint rIRIS tokens.

-

LiquidityUnbond: LiquidityUnbond is the entry point for users to redeem their IRIS tokens on StaFiHub.

-

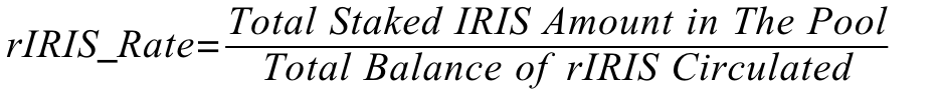

Exchange Rate of rIRIS: Exchange Rate of rIRIS is used to calculate how many rIRIS tokens to mint for a user’s LiquidityBond and how many IRIS tokens should be unbonded and transferred back. It is initialized to 1 and calculated as follows: